C. Boyden Gray’s recent WSJ column,“Banks’ Boycott Is an Antitrust Problem” rings a bell with CLW. As one might imagine, the pressure campaign on lenders participate in “an effort to starve oil and gas [and coal] companies of capital”, runs deeper than what we see on the surface.

The details also are uglier than even the excitable public advocacy described by Mr. Gray suggests.

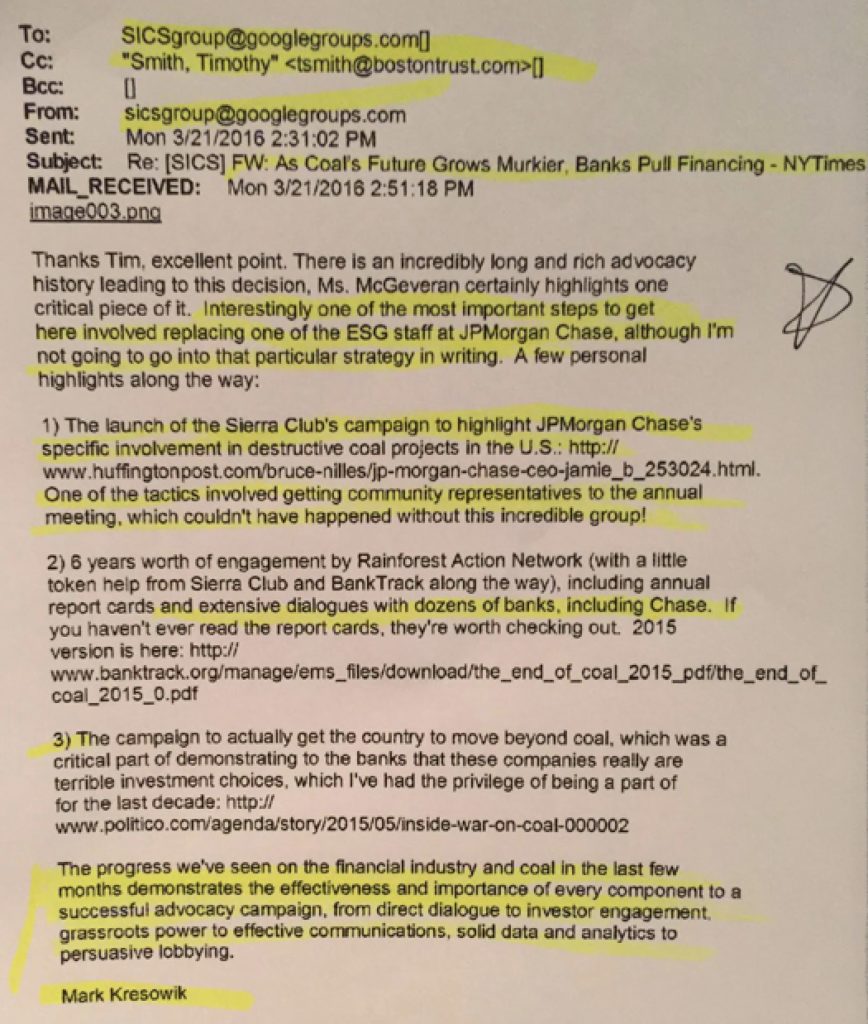

Consider a March 2016 email released in response to a state open records request. In an exchange discussing a New York Times op-ed on the campaign, a Sierra Club “Beyond Coal” activist boasts to an advisor to institutional investors, “There is an incredibly long and rich advocacy history leading to this decision” by large banks to retreat from financing coal. “One of the most important steps to get here involved replacing one of the ESG staff at JPMorgan Chase, although I’m not going to go into that particular strategy in writing.”

That certainly seems of possible interest to those targeted by this campaign.

Individuals can reach their own conclusions about why the reticence to go further, in writing.

The good news about this glimpse behind the curtain is that some such discussions are subject to open records laws, because the email forum called the “Shareholder Initiative on Climate and Sustainability” Google Group includes like-minded officials in numerous state treasuries. That’s also the bad news.

PS Thank Goodness JP Morgan got that green religion!